Introduction

Online shopping has become a staple of modern consumer behavior, offering convenience, variety, and often better pricing than brick-and-mortar stores. But savvy shoppers know there’s another benefit—earning rewards points on every purchase. By strategically using the right credit cards, shopping portals, and promotional offers, consumers can maximize their earning potential and get closer to valuable travel, cashback, and gift card rewards.

In this guide, we will explore the best strategies for earning points on online shopping, equipping you with the knowledge to make every dollar count. Visit WeDoPoints.com for more in-depth strategies and expert insights on maximizing your rewards.

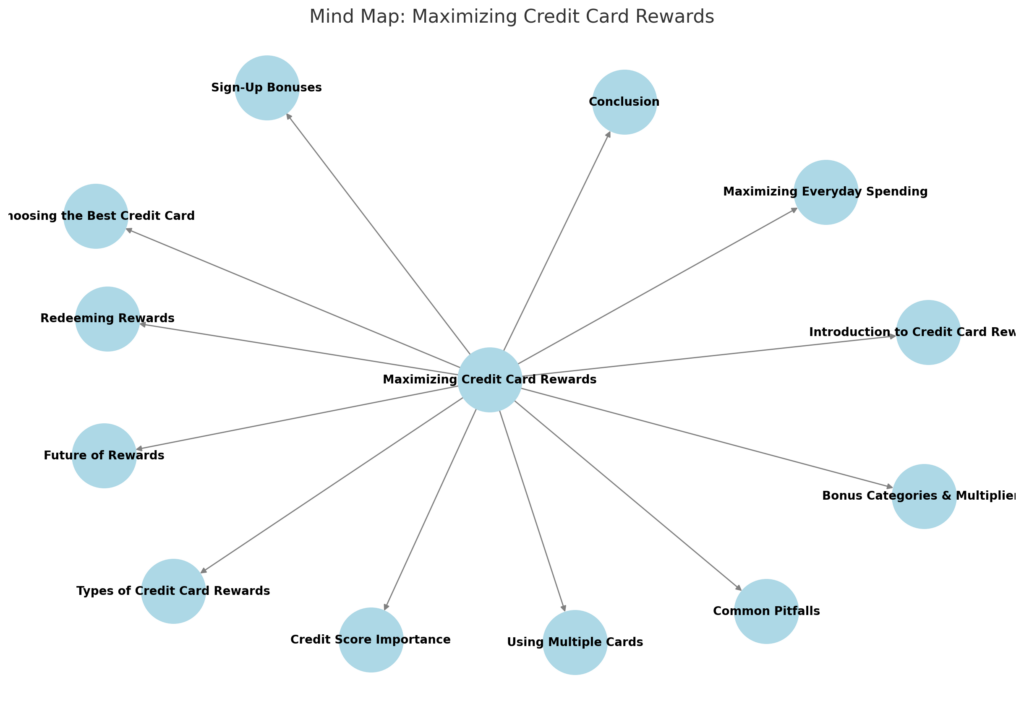

1. Choose the Right Credit Card for Online Purchases

Not all credit cards offer the same rewards structure. Some cards provide higher rewards for online shopping, while others focus on categories like travel or dining. Here’s what to look for when selecting the best card:

Key Features of a Great Online Shopping Credit Card:

- High rewards rates on online purchases – Some cards offer 3X, 5X, or even higher points per dollar spent on e-commerce platforms.

- Category bonuses – Cards with rotating or fixed categories often include online retail.

- Welcome bonuses – Large sign-up bonuses can provide a significant boost when meeting the minimum spend.

- No foreign transaction fees – Essential for global online shopping.

- Shopping protections – Look for cards that offer purchase protection, extended warranty, and price matching.

Recommended Cards for Online Shopping Rewards

| Credit Card | Online Shopping Bonus | Welcome Offer |

|---|---|---|

| Chase Freedom Flex | 5X points on rotating categories (often includes Amazon, Walmart) | $200 bonus after spending $500 |

| American Express Gold | 4X points on select online retailers | 60,000 points after spending $4,000 |

| Capital One Venture | 2X miles on all purchases | 75,000 miles after spending $4,000 |

| Citi Double Cash | 2% cash back on all purchases | No welcome bonus |

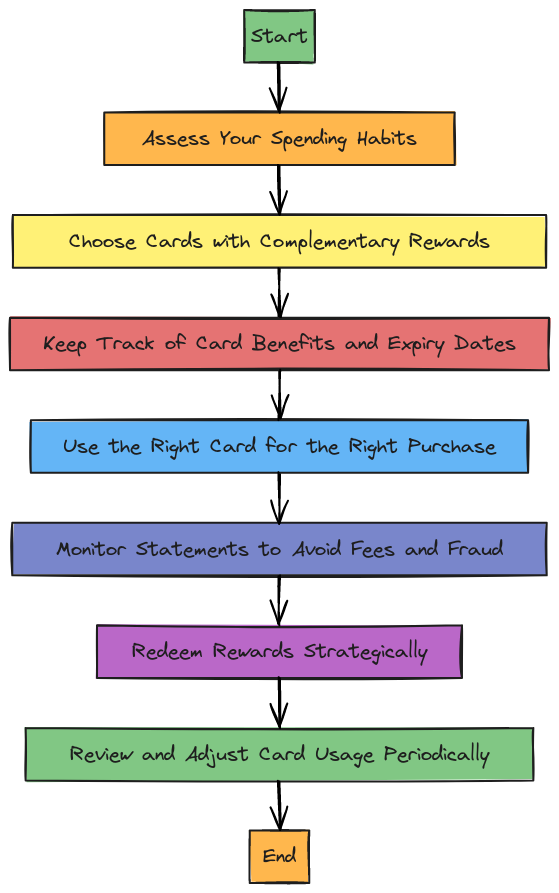

2. Utilize Online Shopping Portals

Shopping portals allow you to stack rewards by earning additional points or cashback when shopping through their links. The best part? You can earn these rewards on top of your credit card points.

How Shopping Portals Work:

- Visit a shopping portal (e.g., Rakuten, Chase Ultimate Rewards, American Airlines AAdvantage eShopping).

- Search for the retailer you want to shop at.

- Click through the link provided by the portal to the retailer’s website.

- Complete your purchase as usual and earn extra points!

Comparison of Popular Shopping Portals

Portal | Typical Points Earned | Best for |

| Rakuten | Up to 10% cashback | Cashback lovers |

| Chase Ultimate Rewards | 1-5X points per $1 | Chase cardholders |

| Amex Membership Rewards | 1-10X points per $1 | American Express users |

| Alaska Mileage Plan | 1-6 miles per $1 | Airline miles enthusiasts |

3. Take Advantage of Promotions and Offers

Many retailers and credit card companies offer limited-time promotions that boost your earnings. Here’s how to stay ahead:

- Opt into credit card offers – Many issuers have targeted promotions where you can earn extra points by enrolling in special deals.

- Check retailer promotions – Amazon, Target, and Best Buy frequently offer extra points or cashback for specific categories.

- Leverage stacking – Combine a credit card offer, shopping portal bonus, and store discount to maximize your savings.

4. Use Subscription Services That Offer Bonus Points

Some subscription services offer extra points on purchases or require spending thresholds that can help you meet bonus criteria faster.

Best Subscription Services for Earning Points:

- Amazon Prime – Often included in rotating bonus categories on some credit cards.

- Walmart+ – Earn extra points when using a card that rewards Walmart purchases.

- Instacart Express – Often included in grocery bonus categories.

- Streaming Services – Some credit cards offer higher rewards rates on subscriptions like Netflix, Disney+, and Hulu.

5. Maximize Points with Gift Cards

Buying gift cards can be an excellent way to earn additional points, especially when purchasing them at a bonus category store.

Best Gift Card Strategies:

- Buy gift cards from grocery stores – Many credit cards offer 3-5X points on grocery store purchases, allowing you to rack up rewards.

- Use a shopping portal – Some portals offer bonuses when purchasing gift cards.

- Stack with retailer promotions – Some stores offer discounts on gift cards, effectively letting you double-dip on rewards.

The Power of Stacking Rewards

To illustrate how stacking strategies work, consider the following scenario:

Example: Earning Maximum Rewards on a $500 Online Shopping Purchase

| Strategy | Reward Earned |

| Chase Freedom Flex (5X bonus category) | 2,500 points |

| Rakuten Shopping Portal (5% cashback) | $25 cashback |

| Retailer Promotion (10% bonus points) | 500 bonus points |

| Credit Card Sign-Up Bonus (if meeting minimum spend) | $200 bonus |

| Total Earnings | 2,500 points + $225 value |

Conclusion

Earning rewards points on online shopping isn’t just about using the right credit card—it’s about strategic stacking and leveraging every available bonus opportunity. By using the best strategies for earning points on online shopping, you can turn everyday purchases into valuable rewards for travel, cashback, or future shopping.

Ready to maximize your points? Stay updated with the latest strategies by visiting WeDoPoints.com, your go-to resource for everything rewards-related!