Introduction

Managing multiple reward credit cards can be a game-changer when it comes to maximizing points, cashback, and travel perks. However, without a proper strategy, it can quickly become overwhelming. By implementing best practices, you can ensure that you stay on top of payments, avoid unnecessary fees, and get the most out of each card. In this guide, we’ll explore effective strategies for managing multiple rewards credit cards, review five proposed approaches, and highlight the top five best credit cards for rewards.

Understanding the Benefits of Multiple Rewards Cards

Using multiple rewards cards effectively allows you to take advantage of various earning structures, sign-up bonuses, and category spending benefits. By strategically utilizing each card’s strengths, you can maximize your rewards and optimize your financial strategy. Key benefits include:

- Maximizing category bonuses: Different cards offer varying rewards on categories like travel, dining, groceries, and gas.

- Leveraging sign-up bonuses: Applying for new cards at the right time can yield substantial bonuses.

- Diversifying points and rewards: Spreading spending across different loyalty programs provides flexibility in redeeming rewards.

- Enhancing travel perks: Some cards provide complimentary travel insurance, lounge access, and waived foreign transaction fees.

- Building credit responsibly: Proper usage can improve your credit score over time.

To make the most of these advantages, adopting a structured approach to managing multiple cards is crucial.

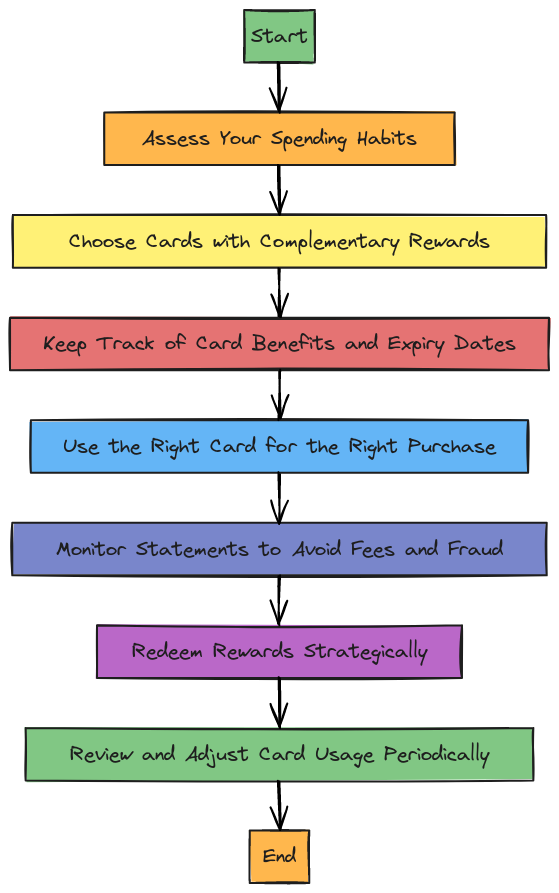

Five Key Strategies for Managing Multiple Rewards Cards

1. Organizing Your Cards Based on Spending Categories

One of the most effective ways to manage multiple rewards cards is by categorizing them based on their bonus spending areas. For example:

- Use a travel rewards card for flights, hotels, and rental cars.

- Use a dining and entertainment card for restaurant spending and subscriptions.

- Use a groceries and gas card for everyday essentials.

- Use a general cashback card for non-bonus spending.

By keeping track of which card offers the best return for specific purchases, you can maximize your earnings effortlessly.

2. Automating Payments to Avoid Interest and Late Fees

To maintain a strong credit score and avoid unnecessary interest payments, automate your card payments. Setting up autopay for at least the minimum balance ensures you never miss a due date. However, it’s best to pay the full balance each month to avoid interest charges.

Additionally, setting up reminders or using financial management apps can help track due dates effectively.

3. Tracking Rewards and Expiration Dates

Many reward programs have expiration policies, making it essential to track points and miles. Utilize:

- Spreadsheets to log balances, expiration dates, and redemption options.

- Apps like AwardWallet, Mint, or Personal Capital to consolidate your card information.

- Bank notifications for points expiration warnings and redemption opportunities.

By staying on top of your rewards, you ensure that you don’t lose valuable points or miles.

4. Rotating Cards to Meet Minimum Spend for Bonuses

If you apply for a new rewards card, you typically need to meet a minimum spending requirement to earn the sign-up bonus. Strategically rotating your cards for large purchases, bills, or everyday expenses can help you meet these requirements without overspending.

A useful approach is to:

- Use a new card exclusively until the spending requirement is met.

- Avoid unnecessary purchases just to reach the threshold.

- Shift spending from another rewards card temporarily to focus on the new card.

5. Reviewing and Adjusting Your Strategy Annually

Credit card rewards and terms change frequently, making it essential to conduct an annual review of your strategy. Consider:

- Annual fees: Are the benefits still outweighing the costs?

- Spending habits: Have your category spending trends changed?

- New card offers: Are there better cards available that align with your goals?

By reassessing your strategy, you can ensure that you continue to optimize your rewards.

Reviews of Five Reward Card Management Strategies

We reviewed five different strategies proposed by financial experts and users to manage multiple reward credit cards efficiently. Here’s how they stack up:

- The Spreadsheet Method

- Pros: Provides detailed tracking of expenses, rewards, and payment due dates.

- Cons: Requires manual updates and can be time-consuming.

- Verdict: Best for individuals who enjoy structured record-keeping.

- Financial Apps and Aggregators

- Pros: Automates tracking of spending, payments, and rewards.

- Cons: Some apps require paid subscriptions for advanced features.

- Verdict: Best for those who prefer automation and minimal manual work.

- One-Card-Per-Category Approach

- Pros: Simplifies decision-making by designating specific cards for specific spending.

- Cons: Requires remembering which card to use for each category.

- Verdict: Best for users with a predictable spending pattern.

- Rotational Card Use Based on Sign-Up Bonuses

- Pros: Maximizes new card bonuses and earning potential.

- Cons: Can lead to excessive applications, impacting credit score.

- Verdict: Best for seasoned credit card users who can manage multiple accounts responsibly.

- The Minimalist Approach (Using Only Two Cards)

- Pros: Easier management and reduced risk of overspending.

- Cons: Limits the rewards potential.

- Verdict: Best for beginners or those who prefer simplicity.

Top 5 Best Credit Cards for Reward Optimization

- Chase Sapphire Preferred® Card

- Best for travel rewards and flexible point transfers.

- Generous sign-up bonus and valuable travel benefits.

- American Express® Gold Card

- Excellent for dining and supermarket purchases.

- 4x points on restaurants and groceries make it a great daily-use card.

- Citi Premier® Card

- Strong rewards for travel, gas, and dining.

- Points transfer to multiple airline partners.

- Capital One Venture Rewards Credit Card

- Best for straightforward travel rewards.

- Flat 2x miles on all purchases with no blackout dates.

- Discover it® Cash Back

- Ideal for rotating category rewards.

- Cashback match feature doubles rewards for the first year.

Final Thoughts

Managing multiple reward cards effectively requires discipline and a solid strategy. By organizing spending, automating payments, tracking rewards, and adjusting your approach periodically, you can maximize your financial benefits. Whether you’re new to credit card rewards or a seasoned points strategist, implementing these best practices will help you stay on top of your game.

For more expert insights on maximizing rewards, visit WeDoPoints.com. Don’t forget to explore our latest guides and strategies at WeDoPoints.com to make the most of your rewards journey.

My Credit Card Management Dashboard

This interactive structure allows users to visualize and organize their credit card strategy effectively. Visit WeDoPoints.com for more tools and tips!