In today’s world of credit cards and reward programs, earning points on everyday purchases has become an integral part of personal finance. These points can translate into significant savings, travel opportunities, or even cashback, making it worthwhile to maximize every purchase. This guide will explore the best strategies to earn the most points on everyday purchases, including the types of cards to use, the best categories to focus on, and tips for maximizing your rewards.

Understanding Credit Card Reward Programs

Before diving into the strategies, it’s essential to understand how credit card reward programs work. Most credit card issuers offer rewards in the form of points, miles, or cashback. These rewards are typically earned at a rate of 1% to 2% of your purchases, but many cards offer enhanced earning rates in specific categories such as groceries, dining, travel, or gas.

Types of Reward Cards

- Cashback Cards: These cards offer a percentage of your purchases back in the form of cash. Some cards provide a flat rate on all purchases, while others offer higher rewards in specific categories.

- Points Cards: These cards earn points that can be redeemed for various rewards, such as travel, gift cards, or merchandise. The value of points can vary depending on how they are redeemed.

- Travel Cards: Travel cards earn miles or points that are specifically geared towards travel-related expenses, such as flights, hotels, and rental cars. These cards often offer the best value when points are redeemed for travel.

- Store-Specific Cards: Some cards are co-branded with specific retailers and offer higher rewards when shopping at those stores. These can be beneficial if you frequently shop with a particular brand.

Selecting the Right Card

The first step in earning the most points on everyday purchases is selecting the right card or combination of cards. Here’s how to choose:

- Assess Your Spending Habits: Look at your monthly expenses and identify the categories where you spend the most. For example, if you spend heavily on groceries, a card that offers high rewards in this category would be ideal.

- Compare Reward Rates: Different cards offer different reward rates for various categories. Compare these rates and choose a card that maximizes your points in your top spending categories.

- Sign-Up Bonuses: Many cards offer significant sign-up bonuses, such as 50,000 points or more, after meeting a minimum spending requirement. These bonuses can give you a substantial points boost right from the start.

- Annual Fees: Some reward cards come with annual fees, but the benefits often outweigh the cost if you use the card strategically. However, if you prefer a no-fee card, there are still plenty of options that offer competitive rewards.

Maximizing Points on Everyday Purchases

Once you’ve selected the right card, the next step is to maximize your points on everyday purchases. Here are some strategies to help you do just that:

1. Optimize Category Bonuses

Many cards offer bonus points in specific categories, such as dining, groceries, gas, or travel. By understanding these categories and planning your spending accordingly, you can earn significantly more points.

- Groceries: If your card offers extra points for grocery store purchases, consider using that card exclusively for this category. Some cards offer up to 5x points on groceries, which can add up quickly if you spend a lot on food.

- Dining: Dining out can be another lucrative category. If you frequently eat out or order takeout, use a card that offers enhanced rewards for restaurants.

- Gas Stations: For those who drive regularly, using a card that offers bonus points on gas can lead to significant savings over time.

- Online Shopping: Some cards offer higher rewards for online purchases or through specific retailer portals. Always check if your card has partnerships with online stores you frequent.

2. Leverage Rotating Category Bonuses

Certain credit cards offer rotating categories that provide higher rewards for specific types of purchases each quarter. While these categories change, they often include common spending areas like groceries, dining, gas, and online shopping.

- Activate and Plan: Make sure to activate these bonuses each quarter and plan your spending to align with the current categories.

- Stack Rewards: If possible, stack these rotating bonuses with retailer-specific promotions or cashback offers for even more points.

3. Use Multiple Cards Strategically

For those serious about maximizing points, using multiple cards to optimize rewards in different categories can be highly effective. Here’s how:

- Primary and Secondary Cards: Designate a primary card for everyday purchases and use secondary cards for specific categories where they offer better rewards.

- Annual Fee vs. No Fee: Consider having a mix of cards, including one with an annual fee that offers superior rewards in your top spending categories, and a no-fee card for everything else.

- Keep Track: Managing multiple cards requires organization. Use apps or spreadsheets to track which card to use for each type of purchase.

4. Take Advantage of Bonus Opportunities

Many credit card issuers offer additional opportunities to earn points beyond regular spending. These can include:

- Referral Bonuses: Some cards offer points for referring friends or family members who apply and are approved.

- Promotions and Offers: Keep an eye out for special promotions, such as limited-time offers for extra points on certain purchases.

- Cardholder Events: Some issuers host events or exclusive sales where cardholders can earn extra points.

5. Use Shopping Portals

Many credit card issuers and reward programs have online shopping portals that offer bonus points for purchases made through their links. These portals often partner with major retailers and can offer significant point multipliers.

- How to Use: Before making an online purchase, check if your card has a shopping portal and see if the retailer you’re buying from is listed. If so, access the retailer’s site through the portal to earn bonus points.

- Stacking with Offers: Combine shopping portal points with retailer-specific promotions or discount codes for even more value.

6. Pay Bills with Your Card

Another way to maximize points is by paying bills with your credit card. Many services, such as utilities, insurance, and streaming subscriptions, allow credit card payments.

- Recurring Payments: Set up recurring payments for your bills on your credit card to earn points automatically.

- Avoid Fees: Some billers may charge a convenience fee for credit card payments. Make sure the points earned outweigh any fees incurred.

7. Utilize Automatic Payments and Subscriptions

Setting up automatic payments for recurring expenses, such as subscriptions and utility bills, not only ensures timely payments but also maximizes point-earning potential. Many people overlook these opportunities, but they can add up over time.

- Subscription Services: Services like Netflix, Spotify, or meal delivery kits can all be paid with a rewards credit card, helping you earn points every month.

- Utilities and Insurance: Some providers allow you to pay your utilities, insurance premiums, or even rent with a credit card. However, be cautious of any convenience fees that could negate your points earnings.

8. Maximize Welcome Bonuses

If you’re signing up for a new credit card, the welcome bonus can provide a significant boost to your points balance. Most bonuses require you to spend a certain amount within the first few months of opening the account.

- Plan Major Purchases: If you’re planning a big purchase, such as a new appliance or home renovation, consider timing it to coincide with a new credit card’s welcome bonus period.

- Combine Spend: If you’re struggling to meet the spending requirement, combine your purchases with a trusted friend or family member who can pay you back. This strategy can help you hit the target faster without overspending.

9. Monitor Your Rewards

It’s crucial to stay on top of your rewards and ensure you’re maximizing every point-earning opportunity.

- Review Statements: Regularly review your credit card statements to ensure you’re getting the correct points for your purchases.

- Track Expiration Dates: Some reward points have expiration dates. Keep track of when your points expire and plan to use them before they disappear.

- Redeem Strategically: Not all redemptions offer the same value. For example, points used for travel often provide more value than those redeemed for merchandise. Do your research and redeem points strategically to maximize their worth.

10. Avoid Interest and Fees

While earning points is great, it’s crucial not to let interest and fees eat away at your rewards. Here’s how to keep your finances in check while maximizing points:

- Pay in Full: Always pay your credit card balance in full each month to avoid interest charges. The interest rates on reward cards can be high, and carrying a balance can negate the value of your points.

- Watch for Fees: Be mindful of any fees associated with your card, such as late payment fees, foreign transaction fees, or annual fees. Some cards may offer fee waivers for the first year, but be sure to factor them into your calculations for long-term use.

Advanced Strategies for Frequent Travelers

If you’re a frequent traveler, there are even more ways to maximize points beyond everyday purchases:

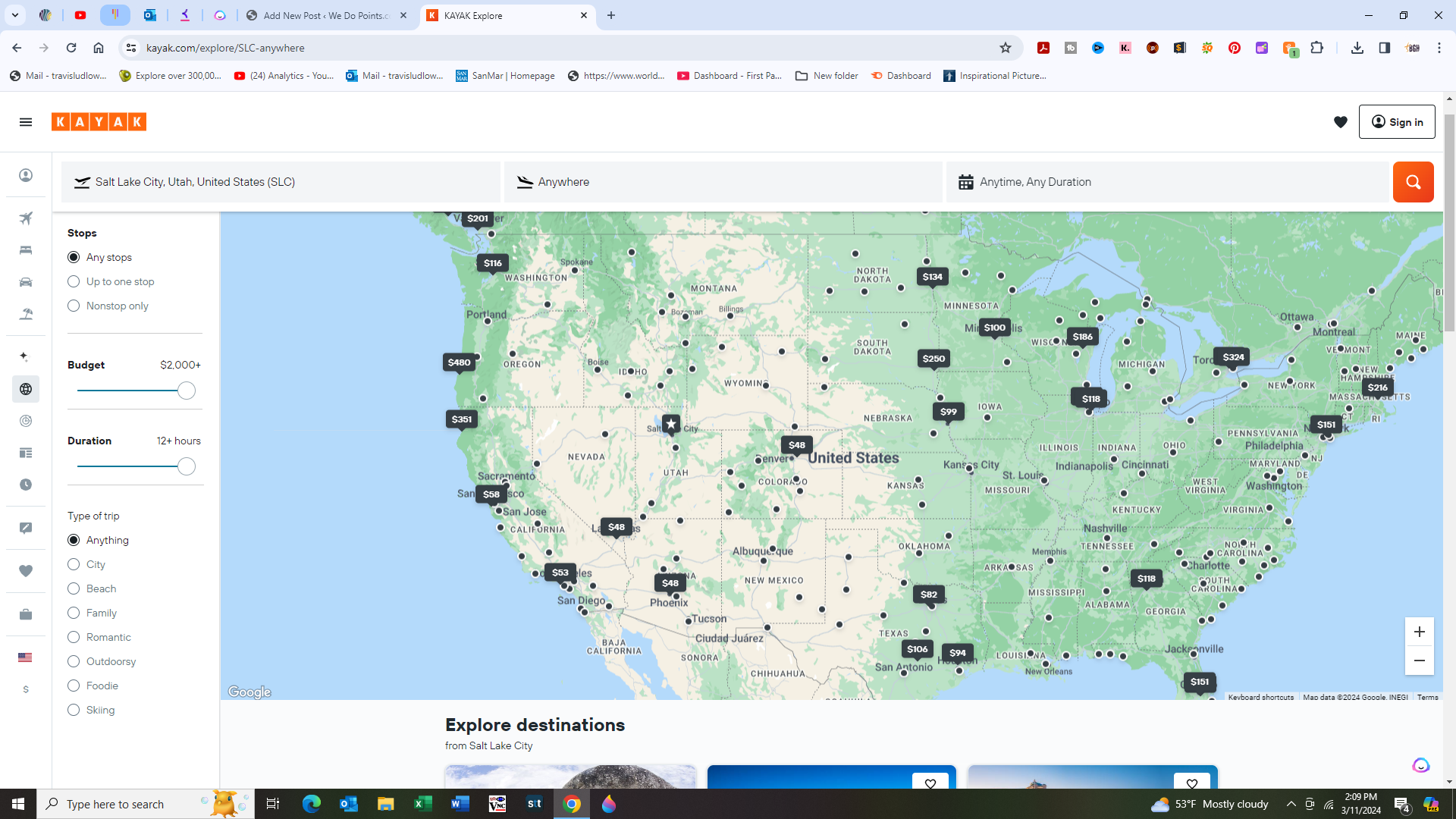

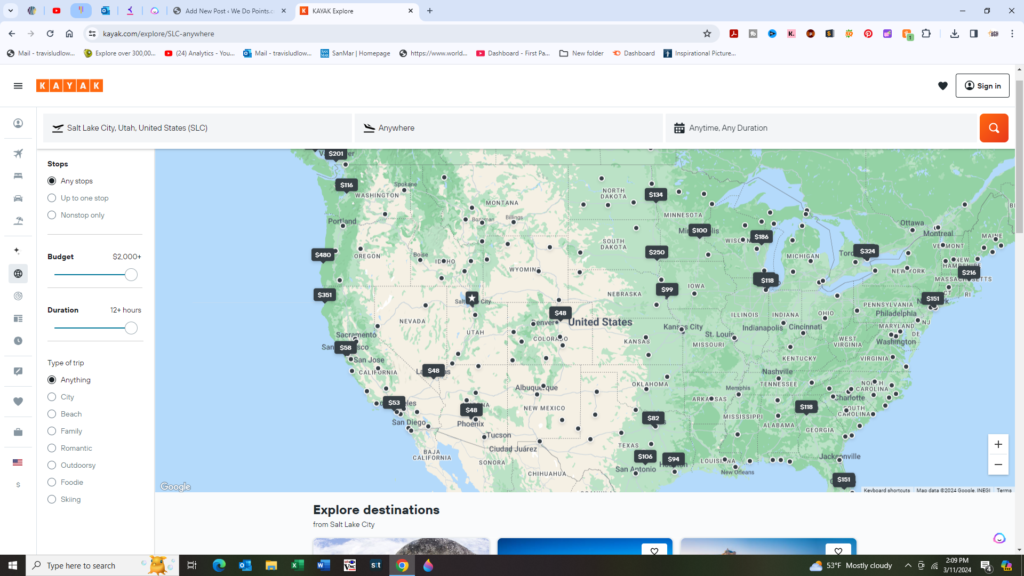

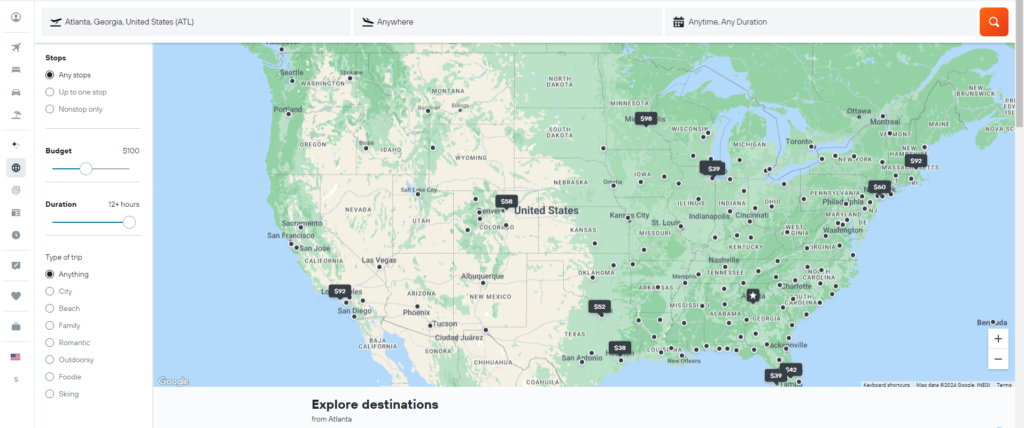

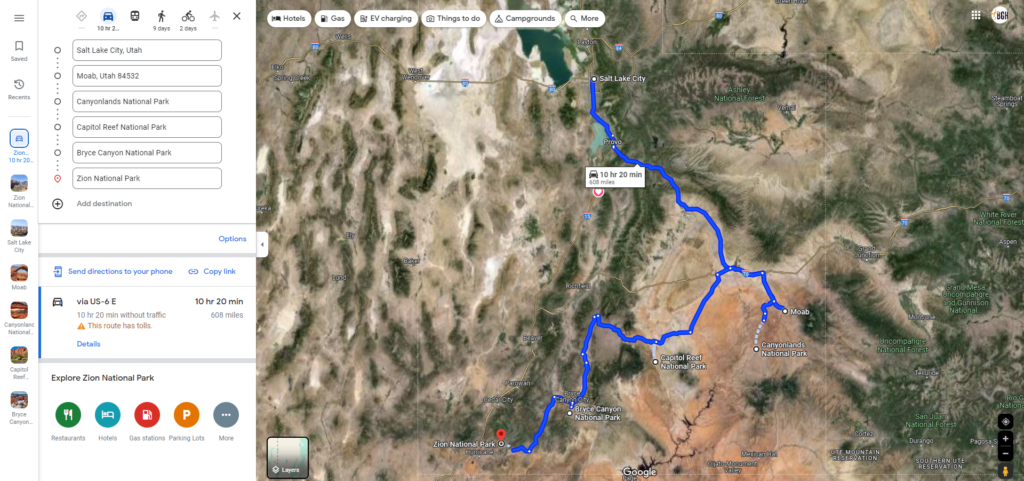

- Transfer Partners: Many travel reward cards allow you to transfer points to airline or hotel loyalty programs. Research transfer partners and look for opportunities where points can be transferred at a favorable rate.

- Travel Redemptions: Points often have the highest value when redeemed for travel. Some cards even offer bonuses when you book travel through their own portals. For example, a point might be worth 1.25 cents instead of 1 cent when used for travel.

- Loyalty Programs: Join airline and hotel loyalty programs and use your credit card to book directly with these brands. Often, you can earn both loyalty points and credit card points on the same booking.

- Airport Lounges: Some premium travel cards offer access to airport lounges, which can enhance your travel experience. While not a direct point-earning strategy, these perks can provide significant value, especially for frequent flyers.

Conclusion: Make Every Purchase Count

Earning points on everyday purchases is more than just a perk; it’s a smart financial strategy that can lead to significant rewards over time. By choosing the right card, optimizing your spending in bonus categories, leveraging rotating bonuses, and using multiple cards strategically, you can maximize your points and get the most out of every dollar you spend.

Remember, the key to success with any rewards program is to stay organized and disciplined. Keep track of your spending, avoid unnecessary fees, and make sure you’re redeeming your points in a way that provides the most value. With the right approach, everyday purchases can lead to extraordinary rewards, making it possible to enjoy more of what you love, whether it’s free travel, cashback, or other perks.

Happy earning!